Learn more about the Freight Trucking industry, and where to find more information about how to open your own Trucking business. Don’t forget you can receive free or low-cost training and free professional business advice, from your local Small Business Development Center!

View our related business reports here: Transportation Industry Research.

Get a free Trucking business plan template on our Business Plans page.

Trucking Business Pandemic Impact & Recovery

The COVID-19 pandemic disrupted the supply chain from a global to local level, including the trucking industry. Here is a look at the impact to the Trucking Business industry.

The trucking industry emerged as an essential service during the COVID-19 pandemic as personal protective equipment, disease tests, and vaccines surged in demand. Further, stay-at-home orders spurred growth in e-commerce and online shopping. As the trucking industry is a key indicator of the U.S. economy, volatility within the industry during the pandemic reflected the country’s economic situation over time. Since 2020, the trucking industry has been on its way to rebound as revenues increased from $732.3 billion (10.13 billion tons of freight) in 2020 to $875.5 billion (10.93 billion tons of freight) in 2021.

Furthermore, supply chain disruption and truck driver shortage are the critical issues affecting the trucking industry. Forbes reports that the Great Resignation, COVID-19 variants, and poor working conditions have contributed to the shortage of drivers. In fact, it is estimated that the industry is short by 80,000 drivers and the shortage is expected to double by 2030. In order to stay afloat, trucking companies pivot to adapt to industry changes by embracing technology innovations, enforcing safety guidelines, and focused efforts to employ more women in the industry. Here are additional pandemic business resources specific to this industry:

- SBDCNet COVID-19 Small Business Resources

- SBDCNet Small Business Reopening Guide

- American Trucking Associations COVID-19 Update Hub

- Truckload Carriers Association Resources for COVID-19

- Bureau of Transportation Statistics – COVID-19 Related Transportation Statistics

Trucking Business Overview & Trends

NAICS Code: 484121, 484110; SIC Code: 4212, 4213, 4214

This Trucking industry summary is from First Research, which also sells a full version of this report.

- “Companies in this industry provide long-distance and local freight trucking, including truckload (TL) and less-than-truckload (LTL) services. Major companies include US-based JB Hunt, Knight-Swift Transportation, Schneider National, XPO Logistics, and YRC Freight, as well as Eddie Stobart Logistics (UK), Hitachi Transport System and Seino Super Express (both based in Japan), and TFI International (Canada).

- Large, wealthy nations such as the US, Japan, and Germany are top markets for trucking, but growth in emerging markets has prompted some companies to expand overseas. China, in particular, has attracted investments from large trucking service providers based in North America and Europe.

- The US general freight trucking industry includes about 80,000 establishments (single-location companies and units of multi-location companies) with combined annual revenue of about $190 billion.

- The industry is comprised of carriers that transport commodities for shippers using a commercial motor vehicle (CMV). This profile covers general freight companies, including for-hire carriers and independent owner-operators, which transport a wide variety of commodities using containers or van trailers. Companies primarily engaged in flatbed, tanker, or refrigerated trailer transport are covered in the Specialty Trucking industry profile. Express delivery services and moving and storage companies are covered in separate profiles.

- Competitive Landscape:The rapid growth of online shopping and quick delivery options is expected to change patterns of demand for trucking services. As the number of brick-and-mortar retail locations declines, so will demand for long-haul dry van trucking…”

Market Segments in the Trucking Industry

The trucking industry is segmented by local and long-distance trucking:

Local Trucking

Local trucking jobs include intrastate hauls. Less-than-truckload hauls, hotshot, and last-mile transportation tend to make up this share of the market. As trucking haul prices are dependent on the types of goods shipped and total distance traveled, the local trucking market has fewer barriers to entry.

Long-Distance Trucking

Long-distance trucking includes interstate and cross-border hauls. The Bureau of Transportation Statistics provides detailed data on miles traveled, traffic volumes, and more.

Trucking Business Customer Demographics

IBISWorld reports on the major market segments for Local Freight Trucking and Long-Distance Freight Trucking in the U.S. The full version of the report is available for purchase.

- The Local Freight Trucking industry generates approximately $91.7 billion and the Long-Distance Freight Trucking generates approximately $260.3 billion in revenues.

- Majority of revenue is generated from manufacturing companies and retail & wholesale establishments

- Manufacturing (41.0%) – Food, beverage, and tobacco manufacturing businesses make up the majority of clients for trucking companies.

- Retail and Wholesale (31.6%) – Retail and Wholesale establishments in areas of lumber, construction materials, and industrial machinery as well as durable goods.

- Other Markets (27.4.0%) – Government Agencies in Utilities, Construction, and Mining sectors

Trucking Business Startup Costs

- Trucking Business Startup Costs from Entrepreneur Magazine – Total Startup costs $10,000 to $50,000.

- How Much Does it Cost to Start a Trucking Company? from Trucker Daily – The cost of starting a trucking company, excluding equipment, ranges from about $6,000 to $15,000. By including equipment, costs range from about $100,000 and to as high as $5 million.

- How to Start a Successful Trucking Business from Truckstop News Magazine – Costs vary depending on the size of your business and whether you want to buy trailers, lease them, or finance. $10,000 to $20,000 to start a trucking company, including the down payment on a truck, insurance, registration, and fees.

- How to Start a Trucking Company from U.S. Chamber of Commerce – You can expect to spend between $10,000 and $20,000 on startup costs.

- How to Run Your Own Coffee Shop from NerdWallet – Trucking can be lucrative, no doubt. It’s also guaranteed to require a fair amount of capital to start a trucking company—a commercial truck costs around $80,000, after all. Then, of course, there’s the capital that goes into keeping your fleet operating at peak performance.

- Steps on How to Start a Trucking Busines from Startup Jungle – Truck Down Payment $7,000; Legal $500; Stationary $300; Licenses and Permits $1,000; Fuel $11,000; Insurance $6,000; Total $32,000.

- Factors of Operating a Trucking Business – Fuel – Diesel fuel is an ongoing expense that can be highly variable; Vehicles and Maintenance – Choosing types of vehicles, buying vs leasing, and number of vehicles, maintenance and repairs; Intangibles – Licensing, business fees, and business insurance; Labor; Marketing.

Trucking Business Plans

- Freight Trucking Business Plan – Bplans

- Owner Operator Trucking Business Plan – Profitable Venture

- How to Create a Trucking Business Plan – Truckstop News Magazine

- How to Write a Trucking Business Plan – Chron Small Business

Trucking-Related Business Regulations

At the federal level, the U.S. Federal Motor Carrier Safety Administration provides guidance on registering a trucking business, such as a USDOT Number. The majority of regulations for the trucking industry are set at the national and state-level. Provided below are some national regulations and standards.

- Federal Motor Carrier Regulations safety standards from the U.S. Department of Transportation addressing employees and cargo

- Classes of Commercial Driver’s License and Learner’s Permits from the Federal Motor Carrier Safety Administration

- Overview of Safety Regulations in Trucking from the Occupational Safety and Health Administration

- Heavy Vehicle Use Tax –fees assessed annually on heavy vehicles operating on public highways from Federal Highway Administration

- National Highway Traffic Safety Administration – education and safety standards & enforcement

- State and Local Transportation – current law, regulations and guidance from the U.S. Environmental Protection Agency

- Commercial Vehicle Safety Alliance – safety standards for the commercial vehicle industry

- Transportation Handbooks and Regulations – transportation handbooks and regulations from the U.S. General Services Administration

- Transport and Trade Regulations – regulation and policy from Journal of Commerce

Trucking Publications

Truck Driver Employment Trends

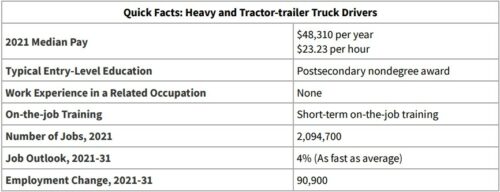

Here is the Heavy and Tractor-trailer Truck Drivers labor market summary from the Bureau of Labor Statistics.

“Pay: The median annual wage for heavy and tractor-trailer truck drivers was $48,310 in May 2021. The median wage is the wage at which half the workers in an occupation earned more than that amount and half earned less. The lowest 10 percent earned less than $30,710, and the highest 10 percent earned more than $72,730.

Drivers of heavy trucks and tractor-trailers usually are paid by how many miles they have driven, plus bonuses. The per-mile rate varies from employer to employer and may depend on the type of cargo and the experience of the driver. Some long-distance drivers, especially owner-operators, are paid a share of the revenue from shipping.”

“Work Environment: Heavy and tractor-trailer truck drivers held about 2.1 million jobs in 2021.

Working as a long-haul truck driver is a lifestyle choice because these drivers can be away from home for days or weeks at a time. They spend much of this time alone. Driving a truck can be a physically demanding job as well. Driving for many consecutive hours can be tiring, and some drivers must load and unload cargo.”

“Job Outlook: Employment of heavy and tractor-trailer truck drivers is projected to grow 4 percent from 2021 to 2031, about as fast as the average for all occupations.

About 259,900 openings for heavy and tractor-trailer truck drivers are projected each year, on average, over the decade. Many of those openings are expected to result from the need to replace workers who transfer to different occupations or exit the labor force, such as to retire. Trucks transport most of the freight in the United States. The need for truck drivers should rise as households and businesses increase their spending and their demand for goods.”

Additional Small Business Resources

Already in business or thinking about starting your own small business? Check out our various small business resources:

- View our business reports here: Small Business Snapshots

- View our small business help topics here: Small Business Information Center

- View our industry-specific research here: Market Research Links

- View our small business cybersecurity resources here: Cybersecurity

- View our pandemic business resources here: COVID-19 Publications

Remember, you can also receive free professional business advice and free or low-cost business training from your local Small Business Development Center!

The latest Auto industry links and resources can be found here: Automotive Industry

The latest Transportation industry links and resources can be found here: Transportation Industry

You can receive free or low-cost training and free professional business advice, from your local Small Business Development Center!